PERS — Retirees vs. Workers?

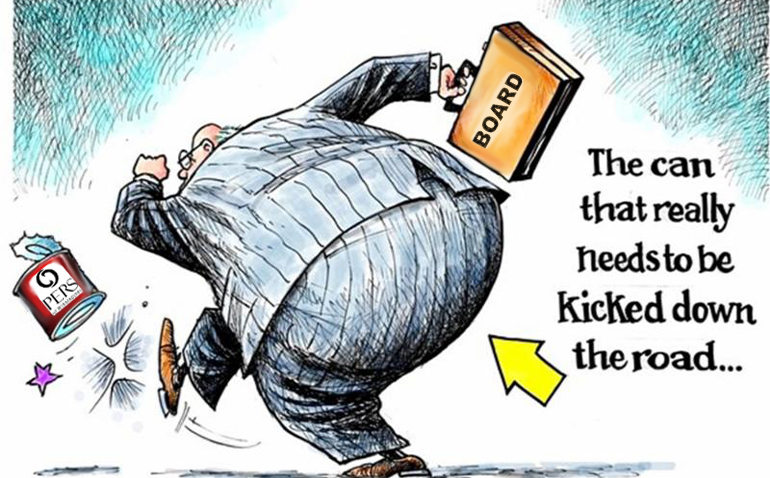

The time for can-kicking is past when it comes to fixing Mississippi’s defined benefit pension system.

The Public Employees’ Retirement System of Mississippi could soon ask taxpayers to increase their contribution to the pensions of state and local employees for the second time in two years.

PERS is the defined benefit pension system for state, county and municipal employees and its administrators that manage the separate pension funds for state troopers and 17 municipalities with a fund that predates the PERS system. PERS also manages an additional supplemental fund (in addition to PERS benefits they will receive) solely for legislators known as the Supplemental Legislative Retirement Plan (SLRP). While PERS is struggling, SLRP’s finances are in solid shape.

For years, PERS officials said their goal was to have the plan funded at 80% by 2042. That goal has seen some slippage. The funding ratio is defined as the share of future obligations covered by current assets and is a critical measure of the health of a pension fund. The funding ratio as of June 30, 2020 was 59%.

Cavanaugh MacDonald Consulting provides actuarial advice for PERS that includes an analysis of funding needs to meet long term future obligations based on expected rates of return. In Section VI of the Conclusion in their PERS 2020 Projection Report, they state, “The projection results for 2020 show that the Plan will have a “Yellow” light status for the funded ratio and cash flow metrics and have a “Red” status for the Actuarially Determined Contribution (ADC) metric.”

They go on to conclude, “This result does not meet the funding goals and benchmarks set by the Board in the current funding policy and an increase in the PERS employer contribution rate should be considered by the PERS Board at this time to get all three metrics back to the green status.”

Cash flows are another metric to evaluate defined benefit plans. The projections for PERS are found in Appendix E and the numbers are alarming — “Many mature retirement systems, like PERS, have negative cash flow, where benefit payments paid out of the trust are more than the contributions being collected by employers and employees. For the fiscal year ending June 30, 2021, we are projecting PERS to have a negative cash flow of approximately $1.29 Billion (benefit payments of $3.09 Billion and contributions of $1.80 Billion).”

That works out to an estimated negative 4.65% cash flow for the fiscal year ending June 30, 2021. This is not good for a number of reasons. When payouts exceed contributions, it puts even more pressure on investment returns. That pressure is further increased by today’s super-low interest rates where the 10 year treasury bond yields less than 1%. The PERS portfolio is 20% debt securities.

There is a mismatch in the goals, obligations and available tools that confront the PERS Board in the years ahead. They continue to cling to a very ambitious expected rate of return of 7.75% in a historically low interest rate environment even as they increase retiree benefits annually with the very generous 3% COLA.

The consequences of this policy mix is to benefit retirees at the expense of many current state workers whose agencies, schools, counties or towns have finite resources. A 17.4% to 19% match to PERS limits their chances of a pay increase.

The $1.29 billion question citizens should ask is this — Is the PERS employer contribution a massive transfer of wealth from current workers to retirees?

Sign up for BPF’s latest news here.

Guess what Mississippi? The only folks the “leaders” are serving and protecting is themselves.

PRIVATIZATION is the new buzz word in Mississippi because they are broke – and with the forthcoming increase of state employer contributions going to 19.4%, EVERYTHING is on the table to be privatized so they don’t have to pay into PERS.

The answer BFP is YES……it’s nothing but an obscene redistribution of wealth from low-paid state workes to retirees…..and it’s unsustainable. If you don’t work for the state, NEWFLASH:

“Get’em off the payrolls!” is their battle-cry behind closed doors, but in front of the microphones, cameras, and of course in interviews with the complicit press and media, all you’ll hear is: “We want to improve parks, roads, bridges, student achievement, health outcomes, etc. etc. etc. We’re doing our best to serve the people of Mississippi.” BULL—-!

PERS is on the verge of collapse without a serious CUT in outflow, or a generous injection of funds……which ain’t there….and in no way can the Feds can’t help them with that, so it’s either a haircut time for state employees (if you haven’t been forced to quit due to your agencies hostilities toward you), or get ready to be folded into privately run enterprise(s)…..with your own 401(k). (i.e. – Read the article on the Mississippi Child Support Program and its privately run affair.)

Chiselers……that’s all they are. Slowly, gradually dismantling state functions to be put into private hands, while securing their own place in the Golden PERS – so only the folks from the last 30 years will benefit from the PERS program they gamed until the end.